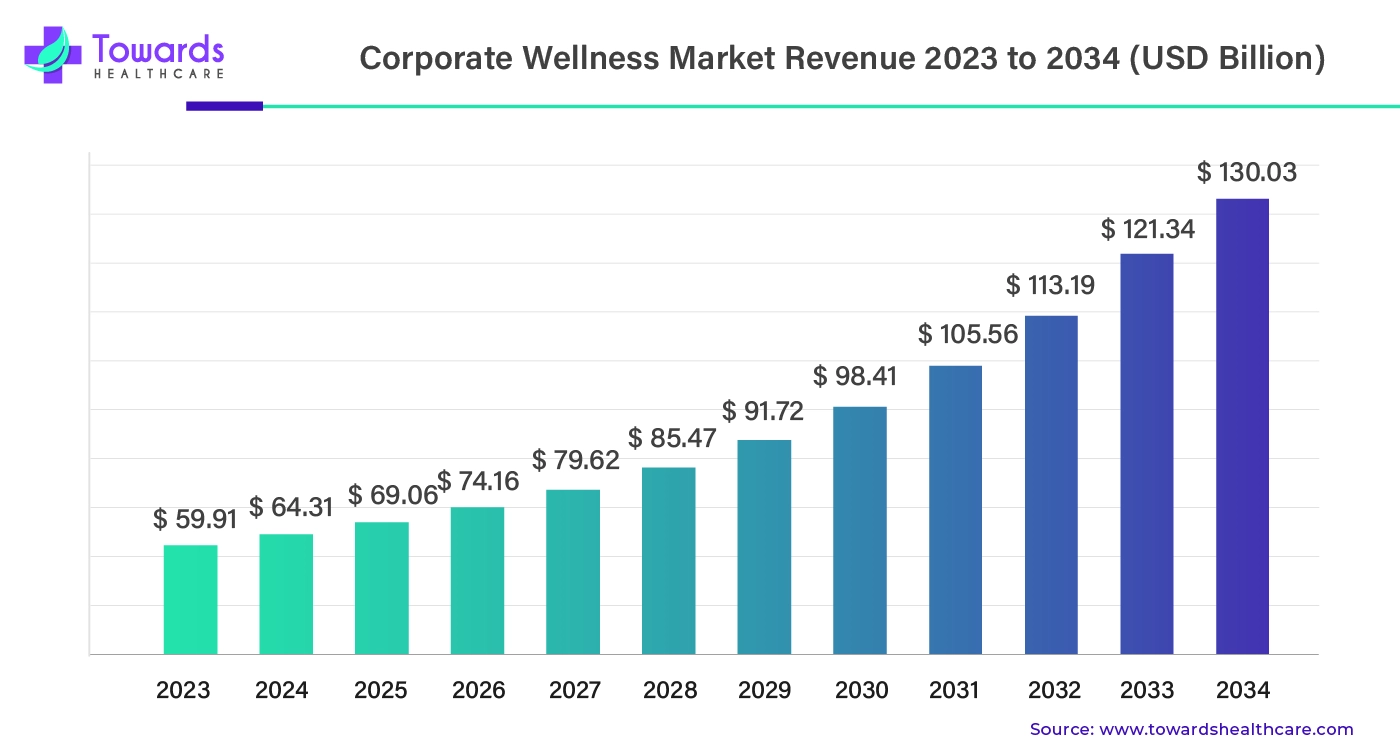

Corporate Wellness Market Size Projected to Attain USD 130.03 Bn by 2034

Ottawa, Nov. 19, 2024 (GLOBE NEWSWIRE) -- The global corporate wellness market size was valued at USD 59.91 billion in 2023 and is predicted to hit around USD 121.34 billion by 2033, a study published by Towards Healthcare a sister firm of Precedence Statistics.

Download a sample version of this report @ https://www.towardshealthcare.com/download-statistics/5218

Corporate Wellness Market: An Overview and Industry Potential

Healthy workers are more engaged, focused, and productive, which can lead to higher business performance and innovation. It enables businesses to create healthier, happier, more devoted, and more productive staff, all supporting long-term company success. This market also highlights companies' role in promoting holistic well-being and reflects a more significant cultural trend toward healthier lives.

- The fourth season of Vantage Fit's Global Corporate Virtual Walkathon has begun, the AI-powered wellness platform just announced. From November 5th to December 3rd, 2024, businesses worldwide are invited to participate in this virtual walkathon, which aims to encourage employee health and wellness.

- According to a recent Truworth Wellness research, there has been a notable increase in heart health problems among Indian corporate workers. Since the corporate sector is the primary driver of the nation's economic expansion, the health of its workers is currently in grave danger.

Get the latest insights on healthcare industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Major Trends in Corporate Wellness Market

- Increased awareness and demand for wellness programs: The need for wellness initiatives in business settings has increased as people understand the value of health and preventative treatment. Businesses are becoming aware of the significant impact that health problems, including chronic illnesses, obesity, stress, and mental health disorders, can have on output.

- Rise in preventative healthcare: Corporate wellness initiatives are now more individualized and scalable due to technology's increased accessibility to preventative healthcare solutions including wearable technology, smartphone apps, and online health evaluations. Employees can take preventative action by using wearable technology to track health parameters like physical activity and sleep quality. Another layer of preventative care is being added by employers who are using these technologies to promote healthy behaviors and take early action.

- Mental health has become a critical component of wellness strategies: Digital mental health platforms that offer on-demand access to mental health treatments, such as mindfulness exercises and therapy, are increasingly collaborating with businesses. Platforms such as Headspace and Calm have gained popularity as businesses strive to provide easily accessible, private, and remote mental health support to their staff.

Insights from Key Regions

North America’s Sustained Dominance in Corporate Wellness Market: What till 2040?

Corporate wellness growth is supported by North America's existing healthcare and wellness infrastructure. Advanced telemedicine services, mental health platforms, exercise centers, and other wellness-related services are all part of this infrastructure. These tools are easily accessible to employers and employees, which makes it easier for wellness programs to be widely adopted.

- Exos and INVI MindHealth announce their yearly collaboration for National Suicide Prevention Month.

- In October 2022, leading coaching business Exos announced the release of The Game Changer, its newest digital app, and The Game Changer LIVE, an immersive in-person event accompanying it.

- According to the American Psychological Association, 2022, 76% of respondents said stress affected their health, resulting in symptoms such as headache, fatigue, anxiety, and melancholy or depression.

- According to the American Academy of Sleep Medicine, 2022, 22% of Americans said they almost usually lose sleep at night because of financial concerns, and nearly 90 percent said they do so because of health and economic concerns.

Customize this study as per your requirement @ https://www.towardshealthcare.com/download-statistics/5218

Asia’s Corporate Wellness Industry

Favorable government policies and incentives that support workplace health initiatives, such as tax breaks or subsidies for wellness programs in nations, are advantageous to the Asia Pacific region. Corporate wellness offerings in Asia Pacific are expanding, ranging from yoga classes and gym memberships to mental health counseling and digital wellness platforms, as younger workers in the region prioritize work-life balance and mental health.

- According to a report by Prudent Insurance Brokers based on data from over 3,000 organizations covering 30 lakh employees, there has been a noticeable shift in the median benefits offered by Indian companies to their employees since the Covid-19 pandemic. These benefits include a greater emphasis on wellness initiatives, preventive care, and personalized benefits.

- Jamieson Wellness Inc. declared that, as of April 1, 2023, it will be able to conduct its sales, marketing, and distribution operations directly in China thanks to an agreement to purchase tangible and intangible assets from its Chinese distribution partner.

- The National Crime Records Bureau has reported that the number of heart attack cases increased by a significant 12.5% in 2022 alone. According to the NCRB's most recent report on "Accidental Deaths and Suicides in India," heart attacks claimed 32,457 lives in 2022, up from 28,413 the year before.

Corporate Wellness Market Segmentation

- By service, the risk assessment segment held the dominant share of the corporate wellness market in 2023. Businesses are driven to investigate ways to lower healthcare costs due to the continually rising cost of healthcare. Employers can proactively detect possible costly health problems before they worsen by conducting risk assessments. Employers realize that spending money on risk assessment can frequently save later, more expensive treatments. Because risk assessment-focused wellness programs may provide measurable returns on investment, they have a significant demand.

- By category, the organizations/employers segment held the largest share of the corporate wellness market in 2023. From essential health and fitness examinations to more extensive support, including mental health counseling, stress management classes, dietary advice, financial well-being services, and flexible work schedules, wellness programs have changed over time. Employers assist several facets of an employee's life by taking a more comprehensive approach.

- By delivery model, the onsite segment dominated the corporate wellness market in 2023. Employees no longer need to travel or take time off thanks to onsite wellness initiatives, which provide wellness services suitable to their door. The convenience greatly increases participation rates because employees can easily fit these activities into their regular schedules.

- By end-use, the large-scale organizations segment dominated the corporate wellness market in 2023. Since they usually have larger budgets, large firms can devote more money to comprehensive wellness programs, including nutrition counseling, gym memberships, on-site exercise centers, mental health care, and even wellness technology. For big businesses subject to stringent health and safety laws, comprehensive wellness initiatives can help guarantee compliance. Specific industries, like manufacturing or construction, demand strict adherence to health regulations, and wellness efforts can support this by minimizing workplace injuries.

Competitive Landscape & Major Breakthroughs in the Corporate Wellness Market

The corporate wellness market continues to evolve rapidly, with 2023 witnessing significant advancements and a dynamic competitive landscape. Major players such as ComPsych, Central Corporate Wellness, EXOS, SOL Wellness, Vitality, Privia Health, Wellness Corporate Solutions, and Ivím Health remain dominant in the corporate wellness market.

What is Going Around the Globe?

- In November 2024, to introduce its cutting-edge Ivím at Work corporate wellness initiatives, Ivím Health, a pioneer in customized healthcare solutions with a 4.9-star TrustPilot rating and more than 600,000 registered patients, will increase its direct-to-consumer services.

- In May 2024, Employers can now provide business solutions to enable employees to access weight-related healthcare options, such as behavioral health, medication management, and virtual care, according to WeightWatchers' announcement of its partnership with Personify Health.

- In December 2022, in a strategic move to expand in the area, Amway, a health and wellness firm run by entrepreneurs, announced the launch of Business Innovation Hub in the Central Business District in collaboration with the Singapore Economic Development Board (EDB).

Browse More Insights of Towards Healthcare:

- The digital health market size is calculated at USD 335.51 billion in 2024 and is expected to be worth USD 1,080.21 billion by 2034, expanding at a CAGR of 13.1% from 2024 to 2034.

- The clinical trials market size is calculated at USD 54.39 billion in 2024 and is expected to be worth USD 94.68 billion by 2034, expanding at a CAGR of 5.7% from 2024 to 2034.

- The cord blood banking services market was estimated at USD 33.9 billion in 2023 and is projected to grow to USD 65.36 billion by 2034, rising at a CAGR of 6.15% from 2024 to 2034.

- The drug screening market size was estimated at USD 6.15 billion in 2023 and is projected to grow to USD 10.34 billion by 2034, rising at a CAGR of 4.84% from 2024 to 2034.

- The pharmaceutical CDMO market size was estimated at USD 146.05 billion in 2023 and is projected to grow to USD 315.08 billion by 2034, rising at a CAGR of 7.24% from 2024 to 2034.

- The comparator drug sourcing market size was estimated at USD 1.16 billion in 2023 and is projected to grow to USD 2.24 billion by 2034, rising at a CAGR of 6.15% from 2024 to 2034.

- The physician practice management market was estimated at USD 118.9 billion in 2023 and is projected to grow to USD 291.7 billion by 2034, rising at a CAGR of 8.5% from 2024 to 2034.

- The microbial testing service market was estimated at USD 5.36 billion in 2023 and is projected to grow to USD 14.04 billion by 2034, rising at a CAGR of 9.15% from 2024 to 2034.

- The decentralized clinical trials (DCTs) market was estimated at USD 8.29 billion in 2023 and is projected to grow to USD 38.2 billion by 2034, rising at a CAGR of 14.9% from 2024 to 2034.

- The pharmaceutical logistics market was estimated at USD 105.6 billion in 2023 and is projected to grow to USD 191.1 billion by 2034, rising at a CAGR of 5.54% from 2024 to 2034.

Segments Covered in the Report

By Service

- Health Risk Assessment

- Fitness

- Smoking Cessation

- Health Screening

- Nutrition & Weight Management

- Stress Management

- Others

By Category

- Organizations/Employers

- Fitness & Nutrition Consultants

- Psychological Therapists

By Delivery Model

- Onsite

- Offs

By End-use

- Large Scale Organizations

- Small Scale Organizations

- Medium Scale Organizations

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Discover our detailed Table of Contents (TOC) for the Industry, providing a thorough examination of market segments, material, emerging technologies and key trends. Our TOC offers a structured analysis of market dynamics, emerging innovations, and regional dynamics to guide your strategic decisions in this rapidly evolving healthcare field - https://www.towardshealthcare.com/table-of-content/corporate-wellness-market-sizing

Acquire our comprehensive analysis today @ https://www.towardshealthcare.com/price/5218

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations. We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardsautomotive.com

https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare

Get Our Freshly Printed Chronicle: https://www.healthcarewebwire.com

.

© Copyright Globe Newswire, Inc. All rights reserved. The information contained in this news report may not be published, broadcast or otherwise distributed without the prior written authority of Globe Newswire, Inc.