HDAC Inhibitor Market to Observe Stunning Growth During the Study Period (2020–2034) | DelveInsight

New York, USA, April 24, 2024 (GLOBE NEWSWIRE) -- HDAC Inhibitor Market to Observe Stunning Growth During the Study Period (2020–2034) | DelveInsight

According to DelveInsight’s analysis, the growth of the HDAC inhibitors market is expected to be mainly driven by increasing incidence, a rise in awareness and access to treatment, and robust pipeline activity for cancer indications in the 7MM.

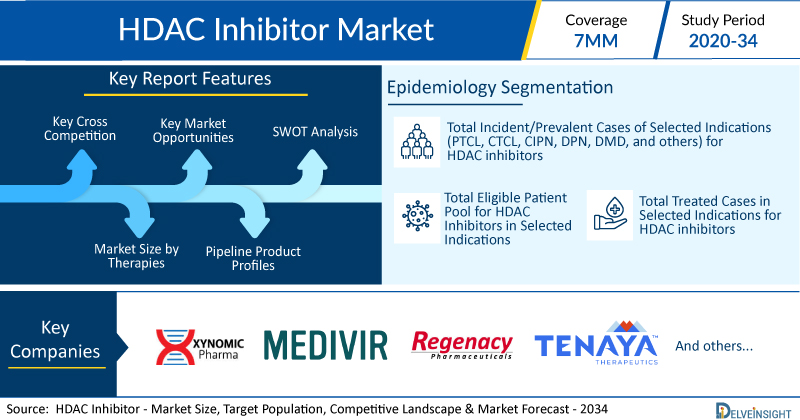

DelveInsight’s HDAC Inhibitor Market Insights report includes a comprehensive understanding of current treatment practices, emerging HDAC inhibitors, market share of individual therapies, and current and forecasted HDAC Inhibitor market size from 2020 to 2034, segmented into 7MM [the United States, the EU-4 (Italy, Spain, France, and Germany), the United Kingdom, and Japan].

Key Takeaways from the HDAC Inhibitor Market Report

- As per DelveInsight’s analysis, the HDAC inhibitor market is anticipated to grow at a significant CAGR by 2034.

- Leading HDAC inhibitor companies such as Xynomic Pharma, Medivir, Regency Pharmaceuticals, Tenaya Therapeutics, and others are developing novel HDAC inhibitors that can be available in the HDAC Inhibitor market in the coming years.

- Some of the key HDAC inhibitors include Abexinostat, Remetinostat, Ricolinostat, and TN-301, among others.

- In September 2023, Italfarmaco Group announced that its Marketing Authorization Application (MAA) for Givinostat (HDAC inhibitor) as a potential treatment for Duchenne Muscular Dystrophy (DMD) had been submitted to the European Medicine Agency (EMA) and that the EMA had started its regulatory review process.

Discover which therapies are expected to grab the HDAC inhibitor market share @ HDAC Inhibitor Market Report

HDAC Inhibitor Market Dynamics

The HDAC inhibitors market has seen a remarkable surge in recent years, driven by the expanding understanding of epigenetics and the role these inhibitors play in various diseases. HDAC inhibitors are a class of compounds that modulate gene expression and have shown promise in treating cancer, neurological disorders, and other conditions. One of the primary dynamics shaping this market is the constant quest for more effective and safer drugs. Researchers and pharmaceutical companies are tirelessly working on developing novel HDAC inhibitors with improved efficacy profiles and reduced side effects, aiming to address the unmet medical needs of patients.

Additionally, the competitive landscape within the HDAC inhibitor market continues to evolve rapidly. With numerous players ranging from large pharmaceutical companies to biotech startups, there is a flurry of activity in research and development. Licensing agreements, collaborations, and acquisitions are common occurrences as companies strive to gain a competitive edge and expand their portfolios. This competitive environment not only fosters innovation but also presents challenges in terms of market fragmentation and pricing pressures, as companies vie for a share of the growing market.

Moreover, regulatory factors significantly influence the HDAC inhibitor market dynamics. The approval process for these drugs can be complex, with regulatory bodies closely scrutinizing safety and efficacy data. As the understanding of these inhibitors deepens, regulatory agencies are updating their guidelines and requirements, impacting the development timelines and market entry strategies of companies. Balancing the need for rigorous safety evaluations with the urgency to bring innovative therapies to patients remains a delicate equilibrium, shaping the strategic decisions and market behavior of stakeholders in the HDAC inhibitor arena.

HDAC Inhibitor Treatment Market

HDAC inhibitors present an encouraging outlook for cancer treatment, demonstrating strong anti-cancer properties with minimal toxicity in blood-related cancers. Moreover, they exhibit potential for managing mental health conditions and are under investigation for their effectiveness in combating fibrosis, inflammation, and diabetes. Despite a range of observed effects in early trials, the exact clinical mechanism is still unclear, posing a continued challenge to pinpointing the most suitable inhibitor for particular illnesses.

ISTODAX (romidepsin), developed by Bristol Myers Squibb, is an epigenetic treatment falling under the category of cancer medications called HDAC inhibitors. In August 2021, its accelerated approval for PTCL was rescinded due to a Phase III study not meeting its main effectiveness goals. Consequently, the drug was removed from the US market. Nevertheless, Istodax continues to be an option for CTCL patients who have received previous systemic treatment.

ZOLINZA (vorinostat), developed by Merck, is used to treat skin symptoms in patients with CTCL who have disease progression, persistence, or recurrence after trying two other systemic treatments. In November 2006, ZOLINZA became the initial HDAC inhibitor sanctioned by the FDA for addressing skin symptoms in individuals with CTCL, a form of non-Hodgkin's lymphoma, who have disease progression, persistence, or recurrence after two systemic therapies.

BELEODAQ (belinostat), developed by Acrotech Biopharma, is a medication that inhibits histone deacetylase. It is used to treat adults with PTCL that has returned or not responded to previous treatments. In July 2014, the US Food and Drug Administration provided accelerated approval for Beleodaq (belinostat) to treat PTCL, which is a rare and aggressive form of NHL.

Learn more about the FDA-approved HDAC inhibitor @ HDAC Inhibitor Drugs

Key Emerging HDAC Inhibitors and Companies

Some of the drugs in the pipeline include Abexinostat (Xynomic Pharma), Remetinostat (Medivir), Ricolinostat (Regency Pharmaceuticals), and TN-301 (Tenaya Therapeutics), among others.

Abexinostat, a new type of drug known as an HDAC inhibitor, works by targeting specific enzymes in the body. These inhibitors, in turn, slow down the growth of cancer cells and promote their death, a process called apoptosis. Abexinostat is currently being tested in important global clinical trials for treating renal cell carcinoma, where it's being used alongside pazopanib, and for non-Hodgkin’s lymphoma as a standalone treatment. It's now in the final stages of Phase III trials for renal carcinoma and in Phase II for follicular lymphoma and diffuse large B-cell lymphoma. Furthermore, it's in the early stages of clinical testing for various solid tumors.

In September 2019, Xynomic Pharma announced that the US FDA had given their leading drug candidate, abexinostat, a Fast Track designation. This designation was specifically for using abexinostat as a standalone treatment in the fourth-line therapy for relapsed or refractory follicular lymphoma.

Remetinostat, a HDAC inhibitor, differs from traditional HDAC inhibitors in its ability to be topically applied, targeting the skin specifically. While HDAC inhibitors are approved for treating late-stage MF-CTCL patients, they are not recommended for those in early stages due to their notable side effects. Three phase II trials, one focusing on MF-CTCL and two investigator-led studies centered on basal cell carcinoma and squamous cell carcinoma, have demonstrated remetinostat's positive clinical effectiveness and tolerability within the skin, without causing systemic side effects.

Ricolinostat, a novel oral inhibitor of the microtubule-modifying enzyme HDAC6, is at the forefront as a first-of-its-kind treatment. HDAC6 plays a pivotal role in regulating various cellular functions like protein breakdown, cell movement, and interactions between cells. Regenacy Pharmaceuticals highlights the inadequacies of current temporary treatments for neuropathic pain associated with DPN, citing poor tolerance, minimal effectiveness, and potential for addiction. In contrast, Ricolinostat offers sustained relief and the ability to reverse neuropathic pain by restoring peripheral nerve function, thereby addressing the loss of sensation in the extremities. The company is actively engaged in a Phase II trial for DPN treatment and is eager to explore further partnerships to expand its range of HDAC inhibitors.

The anticipated launch of these emerging therapies are poised to transform the HDAC inhibitors market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the HDAC inhibitors market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about HDAC inhibitor clinical trials, visit @ HDAC Inhibitor Treatment Drugs

HDAC Inhibitor Overview

HDAC inhibitors are medications designed to impede or reverse the process of gene 'silencing' performed by specific enzymes known as histone deacetylases (HDACs). There are four classes of HDAC enzymes: Rpd3-like proteins (Class 1), Hda1-like proteins (Class 2), Sir2-like proteins (Class 3), and HDAC11 (Class 4). These inhibitors are categorized into hydroxamic acid derivatives, benzamides, carboxylic acid derivatives, electrophilic ketones, and cyclic peptides. They have been tested in cancer patients, particularly those with blood-related cancers, with both pan-HDAC inhibitors and class-specific or isoform-specific inhibitors showing promising results in clinical settings.

The progress seen with HDAC inhibitors in clinical trials emphasizes the need for continuous exploration and advancement in this field. Their possible applications extend from cancer-related to neurodegenerative ailments, highlighting their importance in the medical field. The increasing number of clinical trials and preliminary studies indicates a growing list of potential uses for HDAC inhibitors. Moreover, the encouraging effectiveness of these inhibitors in non-cancerous conditions is expanding the breadth of research in both clinical trials and early-stage development.

HDAC Inhibitor Epidemiology Segmentation

The HDAC inhibitor report takes into the account of historical, current, and forecasted HDAC inhibitor patient pool. The HDAC inhibitor market report proffers epidemiological analysis for the study period 2019–2032 in the 7MM segmented into:

- Total Incident/Prevalent Cases of Selected Indications (PTCL, CTCL, CIPN, DPN, DMD, and others) for HDAC inhibitors

- Total Eligible Patient Pool for HDAC Inhibitors in Selected Indications

- Total Treated Cases in Selected Indications for HDAC inhibitors

Download the report to understand what epidemiologists are saying about how HDAC inhibitor patient trends in 7MM @ HDAC Inhibitor Epidemiological Insights

| HDAC Inhibitor Report Metrics | Details |

| Study Period | 2020–2034 |

| HDAC Inhibitor Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Key HDAC Inhibitor Companies | Xynomic Pharma, Medivir, Regency Pharmaceuticals, Tenaya Therapeutics, and others |

| Key HDAC Inhibitor | Abexinostat, Remetinostat, Ricolinostat, and TN-301, among others |

Scope of the HDAC Inhibitor Market Report

- HDAC Inhibitor Therapeutic Assessment: HDAC Inhibitor current marketed and emerging therapies

- HDAC Inhibitor Market Dynamics: Attribute Analysis of Emerging HDAC Inhibitor Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, HDAC Inhibitor Market Access and Reimbursement

Discover more about HDAC inhibitor drugs in development @ HDAC Inhibitor Clinical Trials

Table of Contents

| 1. | HDAC Inhibitor Market Key Insights |

| 2. | HDAC Inhibitor Market Report Introduction |

| 3. | HDAC Inhibitor Market Overview at a Glance |

| 4. | HDAC Inhibitor Market Executive Summary |

| 5. | Disease Background and Overview |

| 6. | HDAC Inhibitor Treatment and Management |

| 7. | HDAC Inhibitor Epidemiology and Patient Population |

| 8. | Patient Journey |

| 9. | HDAC Inhibitor Marketed Drugs |

| 10. | HDAC Inhibitor Emerging Drugs |

| 11. | Seven Major HDAC Inhibitor Market Analysis |

| 12. | HDAC Inhibitor Market Outlook |

| 13. | Potential of Current and Emerging Therapies |

| 14. | KOL Views |

| 15. | Unmet Needs |

| 16. | SWOT Analysis |

| 17. | Appendix |

| 18. | DelveInsight Capabilities |

| 19. | Disclaimer |

| 20. | About DelveInsight |

Related Reports

KRAS Inhibitors Market Size, Target Population, Competitive Landscape & Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key KRAS inhibitors companies, including Novartis, Roche, Genentech, Verastem Oncology, Revolution Medicines, Cardiff Oncology, Immuneering Corporation, Jacobio Pharmaceuticals, BridgeBio Pharma, Mirati Therapeutics, Deciphera Pharmaceuticals, Elicio Therapeutics, InventisBio, Gritstone Bio, D3 Bio, among others.

PD/L-1 Inhibitors Market Size, Target Population, Competitive Landscape & Market Forecast – 2034 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key PD/L-1 inhibitors companies, including Merck, Laekna Therapeutics, Genentech, Tracon Pharmaceuticals Inc., Celgene, MedImmune, Hangzhou Sumgen Biotech, among others.

TROP-2 Inhibitors Market Size, Target Population, Competitive Landscape & Market Forecast – 2034 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key TROP-2 inhibitors companies, including Daiichi Sankyo, AstraZeneca, Kelun Biotech, Merck, DualityBio, BioNTech, BiOneCure Therapeutics, among others.

HER2+ Market Size, Target Population, Competitive Landscape & Market Forecast – 2034 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key HER2+ companies, including Zymeworks, Jazz Pharmaceuticals, Ambrx, AnBogen Therapeutics, Enliven Therapeutics, Roche, among others.

JAK Inhibitors Competitive Landscape

JAK Inhibitors Competitive Landscape – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key JAK inhibitors companies, including Pfizer, Sierra Oncology, Theravance Biopharma, Dizal Pharmaceutical, Aclaris Therapeutics, Celon Pharma, Incyte Corporation, AbbVie, Galapagos, among others.

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn | Facebook | Twitter

Contact Us Shruti Thakur info@delveinsight.com +14699457679 www.delveinsight.com

© Copyright Globe Newswire, Inc. All rights reserved. The information contained in this news report may not be published, broadcast or otherwise distributed without the prior written authority of Globe Newswire, Inc.